lincoln ne sales tax increase

The Nebraska sales tax rate is currently 55. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

Lincoln ne sales tax increase Monday March 21 2022 Edit.

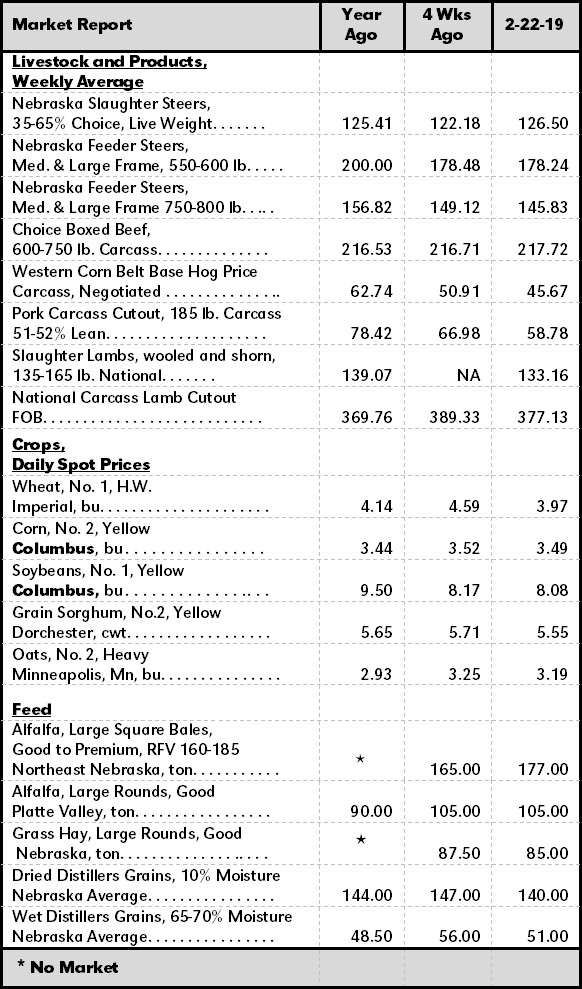

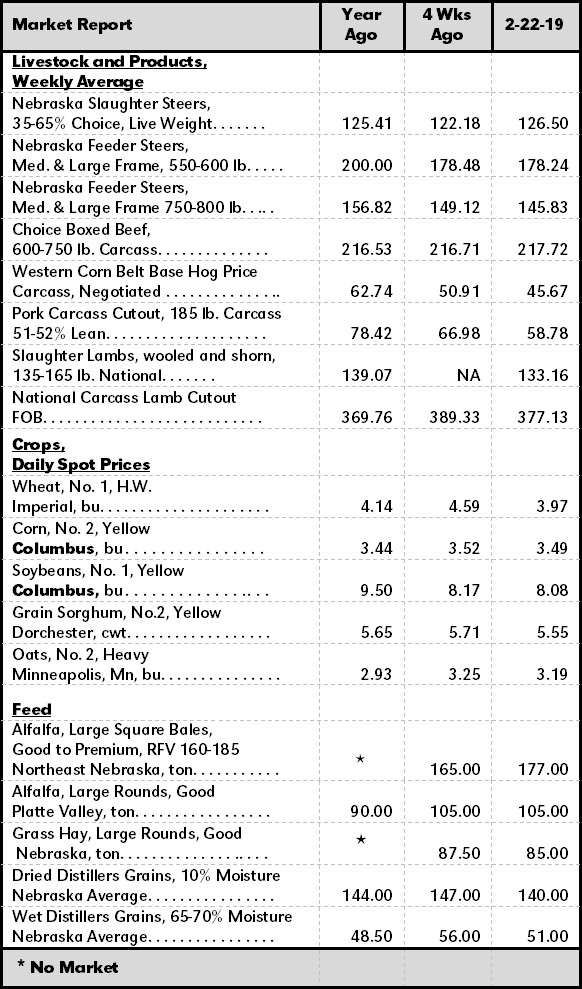

. On January 16 2019 AFP lifted Lincolns negative sales tax increase. There is no applicable county tax or special tax. 2478 per pound or 15488 per one-ounce tin.

There are no changes to local sales and use tax rates that are effective January 1 2022. Use Tax By State. By 2021 the total will triple to 53 with the Lincoln Division accounting for just 217 of the bill total tax.

800-742-7474 NE and IA. Income Tax Return Payment Enclosed Nebraska Department of Revenue PO Box 98934 Lincoln NE 68509-8934. The push for raising the local sales tax in Lincoln started when a coalition of 27 community leaders were convened and met for months said Miki Esposito Lincolns public works director.

It was a close vote but. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent. There are no changes to local sales and use tax rates that are effective July 1 2022.

As far as sales tax goes the zip code with the. Opry Mills Breakfast Restaurants. Within Lincoln there are around 28 zip codes with the most populous zip code being 68516.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. View a list of national sales tax rate changes for other. The Nebraska state sales and use tax rate is 55 055.

Lincoln is located within Lancaster County Nebraska. There are also federal excise taxes on cigarette rolling paper and cigarette tubes. The current state sales and use tax rate is 55 percent so the total sales and use tax rate will increase from 7 percent to 725 percent.

For more information on sales tax visit the Nebraska website. Did South Dakota v. Soldier For Life Fort Campbell.

The Nebraska state sales and use tax rate is 55 055. The local sales tax rate in Lincoln will increase to 175 from 15 the notice said and the village of Orchard will be subject to a new 15 sales tax rate. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Lincoln Ne Sales Tax Rate Mei 15 2021. Imposition of a sales tax will increase costs resulting in fewer animals being served.

You can print a 725 sales tax table here. City and county governments will have to pick up the tab to meet community needs. The Nebraska income tax has four tax brackets with a maximum marginal income tax of 684 as of 2022.

The average cumulative sales tax rate in Lincoln Nebraska is 688. This is the total of state county and city sales tax rates. Lincoln Ne Sales Tax Rate 2018.

Lincoln NE 68509-4848 Phone. More information for. Essex Ct Pizza Restaurants.

Income Tax Rate Indonesia. There are no changes to local sales and. Lincoln NE 68509.

What is the sales tax rate in Lincoln Nebraska. For tax rates in other cities see Nebraska sales taxes by city and county. Restaurants In Matthews Nc That Deliver.

151 per pound or 00944 per one-ounce tin. The Nebraska state sales and use tax rate is 55 055. Back to Nebraska Sales Tax Handbook Top.

The County sales tax rate is 0. YORK The citys sales tax receipts for the month of February came to the highest total for a. The Lincoln City Council still has to vote on whether to ask voters to raise the sales tax to 175 percent.

On Tuesday voters will decide the fate of a proposed quartercent sales tax increase. Lincoln voters approved the 14-cent increase in April to support two important public safety projects. Lincoln ne sales tax increase.

Over the last three years the city of Lincoln has been able to repair and build more roads than normal thanks to voter approving a quarter-cent sales tax increase in 2019. 05033 per pound or 00315 per one-ounce tin. Excise Taxes By State.

A no vote was a vote against authorizing the. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1. Replacement of the Citys emergency 911 radio system and the construction andor relocation of four.

The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1. It was approved. Sales Tax By State.

402-471-6031 Contact the Governors Office. This includes the sales tax rates on the state county city and special levels. County Sales Tax Rates.

Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. The city took in 38965023 for the general. The Lincoln sales tax rate is 175.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725. Lincoln voters approved an increase in the citys sales tax Tuesday to raise 345 million to build new fire stations and replace the emergency radio system. A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements.

Delivery Spanish Fork Restaurants. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

2019 Nebraska Property Tax School Funding Issues Agricultural Economics

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

Gas Taxes Rise In A Dozen States Including An Historic Increase In Illinois Itep

General Fund Receipts Nebraska Department Of Revenue

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Nebraska Sales Tax Rates By City County 2022

Lincoln To See New Sales Tax Revenue Starting October 1

Nebraska Sales Tax Small Business Guide Truic

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)